26 Dec Comings and Goings among Top Business News Of 2006

NEWSPAPER: PEORIA JOURNAL STAR

DATE: 12/26/2006

AUTHOR: ANITA SZOKE

Closures and Power Plays | Year in Area Business Marked By Surprising Farewells, Electric Rate Controversy

Bemis Company Inc., located at the foot of Sloan Street in Peoria since 1912, announced In mid-April that the plant would close. Several hundred employees lost their jobs with the closure, which came only months after the employees were told by the company that It was the top bag manufacturing plant in the country.

PEORIA — There is the closure of several businesses in the area such as Shopko, Cohen’s Furniture Co., K’s Merchandise, Bemis Bag Co.

The debate over higher electricity costs in Illinois turned political. Hourly workers at Keystone Steel & Wire in Bartonville approved a contract and its parent company regained its financial strength.

The Journal Star and other Copley Press newspapers were put up for sale. There was the demolition of the troubled Grandview Hotel and remodeling of nearby Junction City shopping center and other retail properties, such as Westlake Shopping Center.

That’s just a sampling of the type of news that topped the area’s business scene in 2006.

Closing Shop

Several longtime businesses in the area announced they were closing this year, taking some by surprise.

In April, Bemis Company Inc. announced the closure of the Peoria plant, which had been on Peoria’s Riverfront since 1912, coming as a shock to many of its 238 employees. Earlier in the year, workers were told by the company they had the top Bemis bag plant in the country.

“This closure is a result of the company’s need to consolidate operations to improve production efficiency and cost structure,” the company said in a letter to Peoria city officials.

Then in September, Cohen’s Furniture, a mainstay in Peoria for 127 years, announced it would close by the end of the year, saying the pending retirement of its top two officers and the lack of a buyer prompted the decision to close its four stores and warehouses.

“This had nothing to do with business. It’s just that Father Time catches up with everybody. Retail is a very tough business,” said company president Richard Graf. “All things considered, we decided it was time for Cohen’s to say a reluctant goodbye and close all of our stores. This was not an easy decision as Cohen’s has been an integral part of the central Illinois business com- munity since 1879.”

Graf, along with Ray Burns, a Cohen’s employee for more than 30 years and currently chief financial officer, both plan to retire. Given that and the fact none of the other owners wants to take the company over, he said it was time to move on.

In October retailer K’s Merchandise announced it would close its 17 stores in the Mid- west, including in Peoria, after nearly 50 years in business.

The company had struggled in recent years amid increased competition from many different fronts: big box stores, furniture stores, jewelers, sporting goods retailers, even online shopping, said Bill Weinstein, president of K’s Merchandise.

Despite recent efforts to turn the company around, including a cash infusion of tens of mil- lions of dollars, a sales rebound just didn’t happen, he said.

Then in November, Shopko, the Green Bay, Wis.-based retail outlet, announced it would close its stores in Peoria and East Peoria next year because of economic reasons. The stores will operate through the holidays and close in early 2007.

Shopko, which has 135 stores in 13 states, said the nearly 50 employees at each central Illinois store will be offered other positions within the company or receive severance packages.

Energy Debate

On Dec. 20, the state’s utility regulators approved a plan by Ameren Corp., which serves much of downstate Illinois through Ameren CILCO, Ameren CIPS and Ameren IP, to gradually impose dramatically higher electricity prices that take effect Jan. 2. For those who choose to participate in the “Customer Elect Plan,” electric rate increases will be capped at 14 percent in each of the next three years. But participants also will be charged 3.25 per- cent interest for deferred costs.

The plan was criticized by the state attorney general, who calls it a “loan proposal” and that consumers will end up paying more for electricity in the long run.

The debate over higher electricity costs became an intensely political issue this year in Illinois.

In 1997, state legislators implemented a 10-year electric rate freeze as part of a plan to encourage competition that would give consumers low-cost energy options. But competition never developed, and instead, utilities Ameren and ComEd in Chicago dominate the residential market in Illinois.

The freeze ends Jan. 1. Utilities will have to pay significantly more to buy electricity and will be allowed to pass that cost to their customers. Ameren said average residential customers will face an increase of up to 55 percent next year, but Attorney General Lisa Madigan, who has been trying to halt the hikes, said it will be much higher.

The issue played a big role in this fall’s elections, with some lawmakers and public officials supporting an extension of the rate freeze while others were against the idea.

Caterpillar, Keystone Profit

Caterpillar Inc. reported record sales and profit for the third quarter, but lowered its outlook for the remainder of the year and said in its preliminary outlook for next year that 2007 will likely be flat.

The company said the main reasons for that were that truck engine sales would be down after this year’s pre-buy to get ahead of the new federal emission standards to take effect in January, and the weakening housing construction market.

The preliminary 2007 outlook will be updated in January.

Also during 2006, Caterpillar announced it is moving its Asia Pacific operations headquarters to Beijing, China, from Tokyo, Japan; acquired an Alabama-based railroad services company for $1 billion in cash, stock and debt, the second largest acquisition in company history; and realigned manufacturing divisions to better align common manufacturing processes.

Another manufacturer, Key- stone Consolidated Industries, regained its financial strength this year nearly a year after it emerged from reorganization bankruptcy. The Dallas-based company, parent to Keystone Steel & Wire in Bartonville, reported in Augusta profit of $34.8 million through the first six months of 2006. Officials said the company is recapturing some market share it lost during bankruptcy, when customers were unsure of its future because of financial problems.

In May, hourly workers at the Bartonville plant narrowly ratified a new three-year contract, which included wage and insurance changes.

Newspapers for Sale

On Halloween, Copley Press Inc., which has owned the Journal Star for 10 years, told employees it plans to sell its four newspapers in Illinois, including the Journal Star, and its three newspapers in Ohio.

The decision to sell the news- papers came largely because of estate tax implications for Da- vid Copley, company chairman, related to the death of Helen K. Copley in 2004.

The sale process is still in its early stages, but is expected to be completed in the first half of 2007.

In December, John T. McConnell, Journal Star president and publisher for nearly 20 years, announced he will retire at the end of this year, adding that his retirement is related to the upcoming sale.

The sale is an important issue, company officials said, because a sense of community is at stake. The depth and breadth of the coverage of the community could change if a buyer reduces staffing or makes the product less than what it has been, said McConnell.

Acquisitions

Cullinan Properties Ltd. of Peoria, owners of The Shoppes at Grand Prairie, announced in September it sold its Peoria lifestyle center for nearly $94.5 million to Institutional Mall Investors LLC, the same company that bought The Shoppes at College Hills in Normal from Cullinan a month before.

Cullinan will continue to manage and lease The Shoppes.

In October, Peoria-based AFFINA announced it will be acquired by an India-based customer service company, but the move is not expected to affect local employment.

And in November, Multi Ad, an employee-owned Peoria firm that developed into one of the leading marketing service companies in the country, was sold to New York private equity firm Union Capital Corp. No changes are anticipated as a result.

Junction City Revival

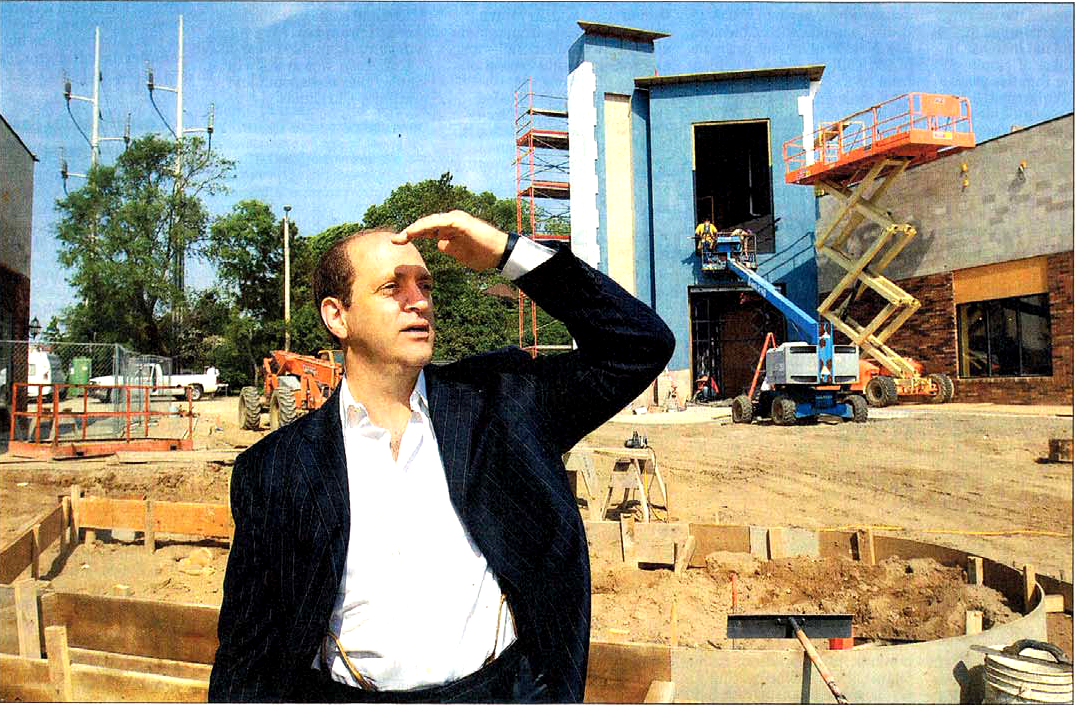

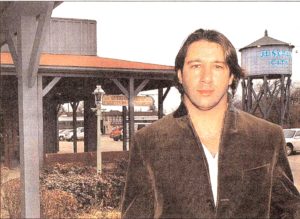

In this photograph taken last February, Alexis Khazzam stands on the boardwalk of Junction City, the Peoria retail complex Khazzam and his wife, Elizabeth Leiter Khazzam, acquired. The Khazzams have since completed many of the major renovations to the complex, with more to come, including converting what is now a warehouse on the property into commercial and retail space.

This year, the beleaguered Grandview Hotel was razed as part of a three-day festival celebrating the makeover of Junction City shopping center.

Developer Alexis Khazzam and his wife, Elizabeth, bought the center and hotel to im- prove the North Prospect area through their developments. Junction City got new retailers, extensive landscaping, fresh paint and other changes to restore it to a family-oriented center with lots of foot traffic and family activities.

Among other properties undergoing remodels were Westlake Shopping Center and the Hotel Pere Marquette.

Cohen Development Co., the owner of Westlake, embarked on a multi-million dollar remodeling project to redevelop and reposition Westlake as an upscale shopping plaza with a neo-classical/Tuscan theme, imported Italian granite and sandstone accents and new storefronts.

At the Pere Marquette, Carnegie’s Restaurant and the Rendezvous lounge got a noticeably new look as part of the hotel’s multi-million dollar makeover. Owners upgraded guest rooms, revamped the restaurant and bar and restored other areas to its original grandeur.

Other news that made head- lines in 2006 included Bud’s Steakhouse changing back to Vonachen’s Old Place and the continued growth of Firefly Energy Inc., a Peoria start-up battery maker that is at work on a lightweight lead acid battery that is expected to revolutionize the industry.